Over the past decade, platform-based business models in the biotech sector have gained in popularity so much that we’ve seen the term devolve into a buzzword that’s added to marketing materials irrespective of whether a company is a platform or not. The interest in platform approaches is a welcome one, but it’s important to understand what defines a platform, and why true biotechnology product platforms (or bioplatforms, as we call them at Flagship Pioneering) are by far the most attractive biotech business models worth building.

At Flagship, we define bioplatforms as a new biotechnology or a new understanding of biology that allows for the intentional and repeatable generation of multiple medicines across different therapeutic areas and/or agricultural and sustainability products. Some examples include Alnylam (RNAi), CRISPR (CRISPR/Cas9), Denali (blood-brain barrier transport vehicle), Ionis (ASOs), Moderna (mRNA), Regeneron (Trap fusion protein, VelociSuite platform), Rubius (red cell therapeutics), and Sana (fusogen platform).

Bioplatforms have several advantages. They have the potential to create numerous product opportunities not only in parallel but also in a highly efficient manner as learning effects from platform optimization and program data create a virtuous cycle of innovation and improvement. They can create multiple related (highly correlated) or unrelated (low correlated) programs, in which the success of a vanguard program substantially derisks future highly correlated follow-on programs. They have the flexibility to rapidly enable new programs in response to unforeseen opportunities. Each of these advantages helps mitigate development risk, enhances potential returns and strengthens the opportunity to build long-term sustainable businesses.

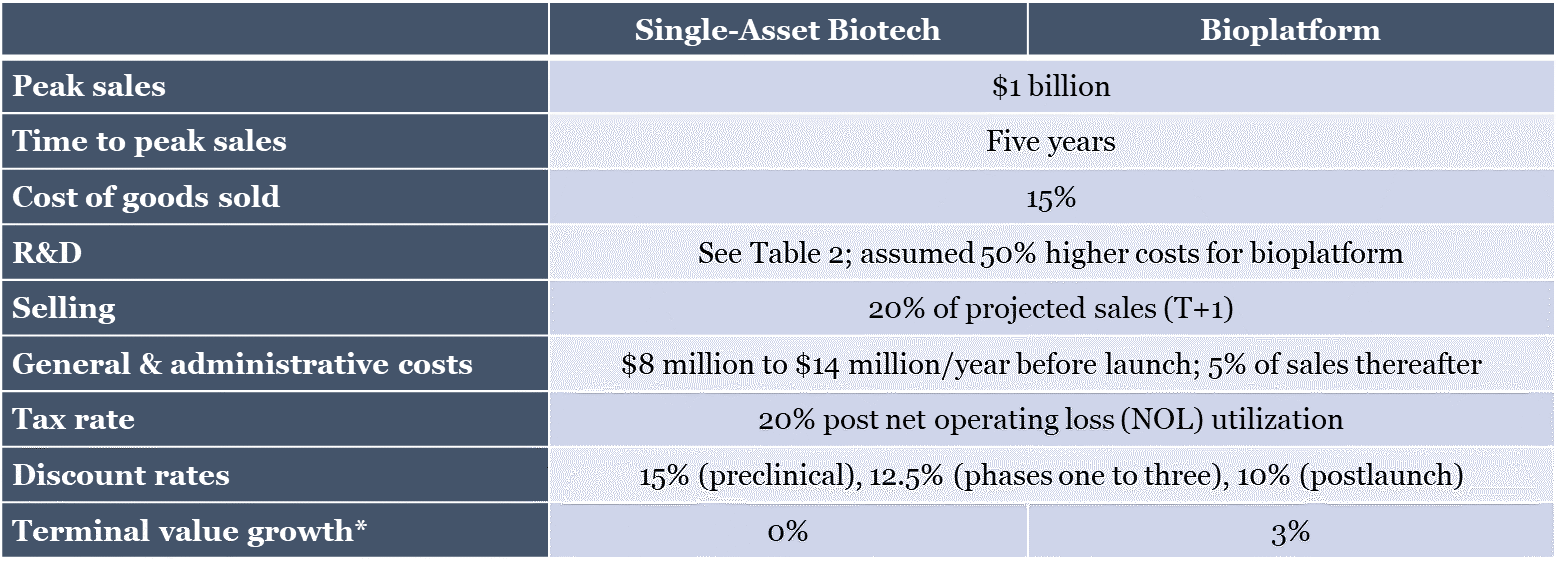

As is the case with any innovation, bioplatforms also present challenges. First, if the bioplatform is novel, it needs to be validated and the programs that are generated need to demonstrate positive clinical proof of concept (POC) data. Second, bioplatforms require more capital, patience and perseverance than other biotech business models, given the need for investment in both clinical programs as well as in platform innovation and optimization.