Computers are getting faster — more computing power now fits in our pockets than was onboard the Apollo space mission. The accelerating pace at which computers compute is due in large part to the number of transistors that can be packed onto a chip. As predicted by Moore’s Law, this number has been increasing since the 1970s. This path of progress is being laid by exponential improvements in computer chip manufacturing technology. We don’t need to know the technical nitty gritty behind these improvements to know they are happening, as nearly every person carrying a cellphone does so with the understanding an update is imminent in the coming years.

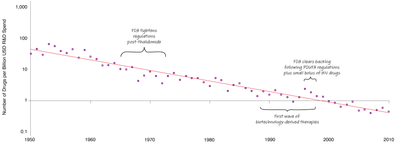

During this period of rapid development in tech, we have seen what appears to be an opposite trend in the pharmaceutical industry. Aptly called Eroom’s Law, Moore’s spelled backward, the number of drugs introduced per billion dollars of R&D spend has steadily declined during each decade since the 1950s. When plotted in terms of internal rate of return, this curve looks scary, plummeting below zero in this decade. This downward path has inflicted damage on the reputation and sustainability of big pharma, which was counted among one of the world’s most respected industries.