News 01.11.2019

Indigo, Inc. Shares January Corn and Soybean Yield Forecasts for the Americas to Help Global Grower Community Navigate Market During US Government Shutdown

- Indigo has the capability to forecast crop yield and production around the globe with recently acquired satellite imaging and machine learning platform whose yield prediction capabilities have outperformed the USDA's in recent years

- With the US government shutdown delaying the release of critical market data, Indigo utilizes newly acquired platform to share directional changes to soybean and corn yield and production forecasts for the Americas, representing 82% and 48% of the world’s supply in these two crops, respectively

- Access to market data is not only critical for grower decision-making and planning, but for buyers, food companies, and the global financial markets, especially in the absence of the January 11th USDA WASDE report

BOSTON--January 11, 2019--Indigo Ag, Inc., a company dedicated to harnessing nature to help farmers sustainably feed the planet, publicizes recent directional changes to soybean and corn yield and production forecasts for the 2018/2019 season across the Americas. With the application of machine learning and artificial intelligence to satellite imagery, Indigo garners global yield performance and production data of crops in real-time. Indigo stakeholders, including growers, leverage this data for various objectives throughout the season.

Due to the United States government shutdown, most operations within the United States Department of Agriculture (USDA) have been put on hold, and key market reports have been delayed indefinitely. The executive department is responsible for publishing the monthly World Agriculture Supply and Demand Estimates (WASDE) report, a comprehensive forecast of crop and livestock supply and demand. Insights from this report are fundamental to informing the global agricultural market, which guides growers’ decision-making.

In the absence of this information, Indigo is sharing agricultural market data for the Americas gathered by its GeoInnovation unit, whose capabilities in predicting yield have outperformed the USDA’s in recent years. For example, in the 2017 season, the GeoInnovation unit, formerly known as TellusLabs, correctly forecasted record-breaking corn yields in the United States in mid-season, compared to much lower numbers from the USDA that the department eventually revised upwards to meet the company’s initial estimates late in the winter.

“Informed market perspectives are fundamental to a grower’s profitability,” said David Perry, Indigo’s CEO. “With access to the right data, a grower decides which inputs to buy, crops to plant, dates to sell, and more – decisions that will affect the rest of his or her season. As a company that wants to support growers’ independence, Indigo is providing this access to streamlined insights, especially since they are otherwise unavailable.”

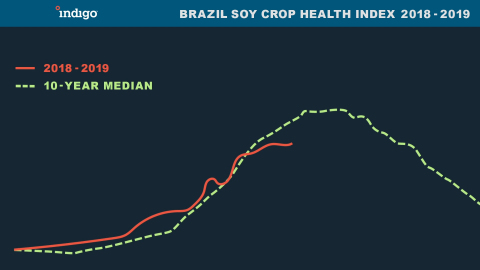

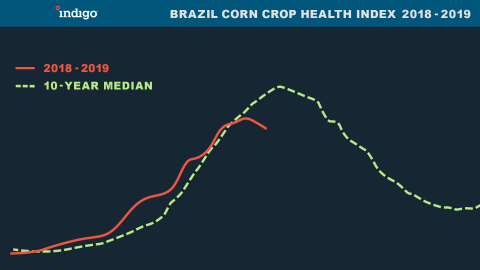

Indigo’s forecasts for soybean and corn production in Brazil have decreased by 6.3% and 5.1%, or 7.3 MMT and 4.9MMT, respectively, since the date of the December USDA report.1 Indigo attributes this downward trend to unevenly distributed dry conditions in the country, resulting from below-average rainfall. In some states, soybeans were planted soon after their permitted planting dates and the dry weather disrupted the plants during the crucial pod-filling phase. Indigo’s Crop Health Index (Image 2) for soybeans in Brazil was higher than normal in November and early December, but it is now below ten-year norms for this stage in the season.

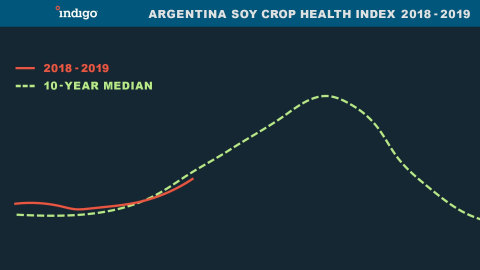

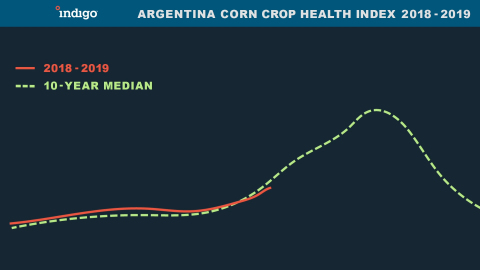

Indigo’s forecast for soybean production in Argentina has not significantly changed since the date of the December USDA report, while its forecast for corn production in the country has increased 1.1%, or 0.5 MMT. Indigo attributes the slight upward trend in corn to a wetter season in the country. Of note, Indigo’s models suggest popular sources are overstating the negative impact of some flooding and hail in the area. Indigo’s Crop Health Index (Image 4) for soybeans in Argentina is slightly behind its normal progress over the past decade, but by a negligible amount.

For soybean and corn yields in the United States, Indigo anticipates final yields below the December 11, 2018 USDA estimates of 52.1 bu/ac for soybeans and 178.9 bu/ac for corn. Indigo’s models have been below both the USDA and market consensus all year, and the company predicts that the USDA’s year-end report will again make downward revisions when they ultimately close out the season after the government shutdown. Late-season flooding led to harvest issues negatively impacting an otherwise robust crop.

“The absence of the January 11th government yield estimates makes data-driven private forecasts more compelling than ever,” said Benjamin Riensche, an Iowa-based grower and advisory board member of Indigo Research Partners. “Even better, this data is virtually real-time, rather than the weeks old data in government reports. It can accurately reflect a quickly evolving situation in Brazil, which appears to be experiencing a shrinking crop in recent dry weather. Here in the US, Indigo’s analytics seem more likely to pick up on soybean yield and quality reductions from wet harvest conditions in North Central and Northeast Iowa, as well as refute the old conventional logic that ‘rain makes grain’ for this prime production area.”

David Potere, Head of GeoInnovation at Indigo, said, “The data we are sharing with growers today represents a small slice of the massive set we generate daily. With our living map of the world’s food supply, we are able to syndicate information from that platform at a moment’s notice, restoring data in the absence of key reports and insights from the USDA. Democratizing data at critical junctures, such as the government shutdown, is just one facet of what our technology can accomplish.”

“Agriculture is perhaps the world's most important manufacturing process and data-based insights like this are critical for growers,” said Geoffrey von Maltzahn, Indigo’s Co-Founder and Chief Innovation Officer. “Indigo is building the leading agricultural data platform to help clarify decisions at planting, harvest, and sale of grain and fiber.”

To learn more about Indigo’s GeoInnovation platform, click here.

About Indigo

Indigo improves grower profitability, environmental sustainability, and consumer health through the use of natural microbiology and digital technologies. Utilizing beneficial plant microbes and agronomic insights, Indigo works with growers to sustainably produce high quality harvests. The company then connects growers and buyers directly to bring these harvests to market. Working across the supply chain, Indigo is furthering its mission of harnessing nature to help farmers sustainably feed the planet. The company is headquartered in Boston, MA, with additional offices in Memphis, TN; Research Triangle Park, NC; Sydney, Australia; Buenos Aires, Argentina; and São Paulo, Brazil. For more information on Indigo Agriculture, please visit www.indigoag.com and follow the company on Twitter, Facebook, and LinkedIn.

Disclaimer

No representation or warranty of any kind (whether expressed or implied) is given by Indigo as to the accuracy, completeness, currency or fitness for any purpose of the above forecasts. As such, this document does not constitute the giving of investment advice, nor a part of any advice on investment decisions. Indigo accepts no liability of any kind and disclaims all responsibility for the consequences of any person acting or refraining from acting in reliance on this press release and any forecasts in whole or in part.

1 Production forecasts for both Brazil and Argentina assume the last area harvested estimate from the USDA.

Contacts

Indigo

Allie Evarts

aevarts@indigoag.com

Hatch for Indigo

Judy Huang

indigo@thehatchagency.com